28 Nov Why You Should Outsource Accounting And Bookkeeping Services?

Hiring an accounting and bookkeeping can be difficult for many smaller companies, start-ups, and entrepreneurs. Particularly if they have the necessary abilities to create their annual financial performance, manage bank account processes, analyze financial information, and prepare incoming invoices. Finally, the issues we encounter with company owners are reasonably common. We all want to save money, make better financial decisions, and save time.

However, a common question arises here: “Why Every Business Should Outsource Accounting and Bookkeeping Services?

The advantages of outsourcing the accounting and bookkeeping tasks, extend beyond cost and time savings. Outsourcing your financial reporting back office gives you the peace of mind. Because that helps to keep your records are being handled while you concentrate on your main business functions. The global accounting and finance outsourcing industry is expected to be worth $50 billion by 2023.

Without further ado, let’s dive into a deeper discussion.

5 Top Benefits Of Outsourcing Accounting Services

Here are the top 5 advantages of accounting services to outsource your accounting activities:

1. Cost-Saving Accounting Services:

Outsourcing to an accounting company, believe it or not, actually saves you cash. When accounting is completed in-house, that person must be added to your payroll.

While this person is unquestionably required, you do not want to keep them on the payroll if they aren’t sending the money into your company. Payroll should be secured for people who bring money into the business.

For example, sales representatives and marketing professionals, as a small business. When your small company grows into a mid-sized operation, you can hire help such as an accountant.

2. Hiring Processes Save Time and Money:

Looking at the big picture, the hiring process is a demanding one. It takes time to manage, from developing a recruitment policy to selecting candidates for interviews.

The recruitment process consumes your company’s time, costs money, and requires you to devote time to either yourself or the worker.

Many businesses do not recognize the time it takes to find a professional Accountant. And time and money are both related. Savings from outsourcing business processes must be accounted for.

3. Accountants And Bookkeepers with Significant Experience:

Outsourcing may allow you to hire an expert with a greater level of knowledge at a lower cost.

To remain competitive in the market, outsourced accounting and bookkeeping services firms must constantly enhance their knowledge and qualifications.

Consider the following scenario: 100 people employed at the same office.

They are able to easily share new accounting trends, solutions, and tools. To add to that, great accounting firms have greater access to courses and training and they are constantly participating.

Furthermore, companies outsource to an accounting company provides you with access to a team of Accountants.

4. Accounting Scalability:

Accounting service providers have the capacity to significantly scale your services without lag.

For instance, if you’re accounting and bookkeeping tasks reach the number of duties for one employee, you can quickly enforce the extra workforce. Without need for to go through a strict recruitment process.

Furthermore, accounting and bookkeeping services bill on an hourly basis. It means you can adjust the hours without interruption.

5. Technologies for Automation:

Accounting automation software is used by most businesses to save time. It saves time, but more importantly, it cuts down.

Accounting automation reduces human errors. Second, accounting software provides real-time reports to accountants. They aid in detecting and resolving potential problems at an early stage. Third, it will lower the risk of internal fraud.

You are wasting time and money if your accounting professionals are still using Excel sheets.

Bonus: An accountant will always offer suggestions on how to improve accounting efficiency. He may occasionally work with a couple of businesses and recommend an incredible experience from another customer. Whether it’s taxation, accounting software, or even financial advice.

Average Cost To Outsource Accounting

When it comes to choosing an accounting and bookkeeping service, many small and medium-sized businesses prioritize cost.

A complete in-house bookkeeper earns around $45,000 per year, while a full-time accountant earns around $60,000. Two employees cost more than $100,000 when combined, not including overhead costs.

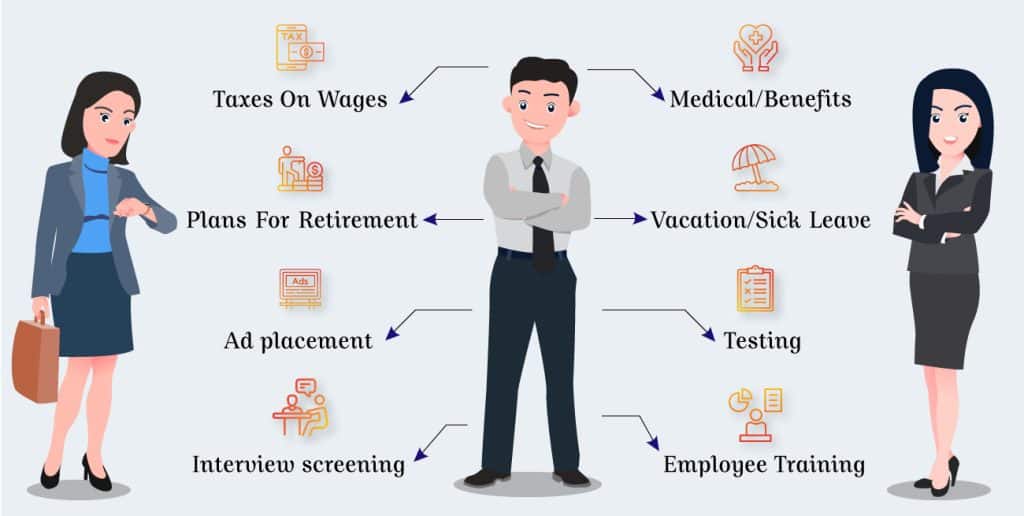

Overhead costs account for 20% of an employee’s base salary and include:

- Taxes on Wages

- Medical/Benefits

- Plans for Retirement

- Vacation/Sick Leave

- Ad placement, interview screening, testing, and employee training

When you use an outsourced service, your company will not incur any overhead expenses. Outsourced bookkeeping, as well as Controller services for small and medium-sized businesses, ranging from $2,500 to $5,000 per month, based on the services required.

Even at the highest end of the range, $5,000 per month would cost your company $60,000 per year, which is significantly less than the cost of an accountant and bookkeeper.

Accounting Outsourcing In Bangladesh

In Bangladesh, accounting services have always been an important business tool. These services have been used in multiple formats and steps of society since the dawn of human civilization.

Accounting assistance in today’s world, professional accountants in Bangladesh are supplied by Eicra Soft Ltd. a prominent and highly regarded consulting company in Bangladesh.

It ranges from simple tally books discovered in small grocery stores to large multinational corporations and everything in between.

Massive advancement and application of IT expertise give this industry a competitive advantage in modern times.

We, as an accounting provider in Bangladesh, have developed numerous accounting tools and software in collaboration with our in-house IT team in order to provide accounting services more efficiently.

Outsourcing Accounting For Small Businesses

Outsourced accounting is an expert suite of services provided to businesses by a third-party firm. Bookkeeping, a company’s financial planning, financial strategy, and other services are common examples.

Outsourced accounting, like any other outsourcing strategy, is tailored to your business’s specific requirements. You will not pay for services that you do not require.

Instead, you’ll be able to select from a number of professional services, such as those listed below, to assist you in making sound decisions.

-

Bookkeeping

Bookkeeping is the most fundamental, foundational financial function of a business, and it is an essential component of all businesses. It entails recording and getting ready all financial transactions as well as other financial operations in order to track revenue and expenditure.

When outsourcing accounting, look for solutions such as vendor invoice processing and credit card transactions.

-

Monthly Accounting

Monthly accounting follows on from bookkeeping. It entails all of the monthly steps that a company should take to maintain accounting data structured and provide market intelligence.

Once outsourcing monthly accounting, assistance such as finalizing the month-end close as well as reconciling income statement accounts are likely. A monthly financial meeting to recognize current operating results may be included in higher-tier services.

-

Forecasting Cash Flows

Any organization’s lifeblood is cash. The ability to predict your cash flow can entail the difference between failure and success when navigating a tense business condition or proactively managing your growth.

An outsourced accounting supplier can assist business owners in avoiding surprise bills or income shifts that can spell disaster by reviewing a company’s cash inflows and outflows on a regular basis.

-

CFO outsourcing

An outsourced CFO may be a good option if your small business is going to experience rapid growth, resolving a problem, or requires a project-based consultant.

A companies outsource CFO is a financial planner and strategic consultant who works part-time or on a project basis for a company. When looking for a company’s outsource CFO, look for an individual who understands what it’s like to own, grow, and run a small business.

-

Support for Operations

Obtaining information to make sound business decisions does not happen by chance. Experience is required to streamline processes as well as optimize finances.

Operational management is a service that evaluates current practices and implements new systems of your company. Defining processes and procedures, assessing internal controls, and developing reports and dashboards are all examples of operational support functions.

Did you know? – 83% of smaller companies plan to increase outsourcing business processes in 2022.

Best Option For Your Business: Outsourced Accounting And Payroll

Hiring someone to manage these tasks is an alternative that most business owners consider. Hiring in-house staff, on the other hand, is not the most useful option for startups as well as smaller companies.

To have an employee on their usual payroll can result in a significant increase in their expenses. Outsourcing may be a much more perfect and cost-effective solution for such businesses.

According to investigation, outsourcing payroll and accounting functions not only saves a company money but also provides a slew of other benefits that help it stay competitive and efficient.

Here are some of the advantages of outsourcing accounting and payroll to your business, as explained in detail by our Specialists:

-

Reduce Operational Costs

One of the strongest reasons for outsourcing accounting and payroll features is to reduce operational costs. Outsourcing these jobs can be extremely cost-effective when tried to compare to hiring full-time employees because companies can avoid paying wages and employer taxes.

-

Collaboration with Experts

Working with experts in the industry means outsourcing to a firm that is dedicated entirely to accounting and payroll management. With their deep expertise, these professionals are well-versed in accounting and payroll processing and are adept at dealing with problems and challenges.

-

Concentrate on the Core Strengths

Accounting and payroll tasks can take a long time to complete. Perhaps it’s time that owners of small businesses or startup founders cannot afford to waste?

Devoting a significant amount of time to these operations month after month causes entrepreneurs to lose focus on what is most important.

Why Accounting Is Called Information System?

Accounting’s primary function is to represent price movements in a meaningful way. It gives data to those who must make decisions or make decisions based on judgments. A decision-maker is bound by certain constraints.

Moreover, he is unable to recall or monitor all relevant events that occur at various times and locations. He may involve facts after the events have occurred. He might not need every specific of an event.

Accounting information is used to predict, compare, and evaluate a company’s earning ability and financial position. It also meets the needs of users who rely on financial statement as their primary source of data for decision making.

Bookkeeping And Accounting Are Same Or Not?

Bookkeeping and accounting are not the same thing. An accountant can be a bookkeeper but a bookkeeper can’t be an accountant. There are many differences between bookkeeping and accounting service.

The following are the distinctions between accounting and bookkeeping:

Accounting Service

It prepares financial reports as well as statements using the information given by bookkeeping.

In addition, it extends beyond bookkeeping and has a wider view than bookkeeping.

The goal of accounting is to notify a company’s financial strength and to obtain the results of its operations.

The goal of accounting is to analyze and interpret financial data in order to make informed decisions.

An accountant is a person in charge of accounting.

Accounting necessitates accountant skills as well as an understanding of various accounting policies and procedures.

The accounting process is used to prepare financial reports and statements.

Accounting methods and procedures for interpreting and analyzing financial reports can differ between entities.

Bookkeeping Service

This is a fundamental component of accounting.

Moreover, it is a component of the overall accounting system.

The bookkeeping process produces information for accounting.

The goal of bookkeeping is to keep a chronological record of economic activities and transactions.

The goal of bookkeeping is to summarize the impact of a company’s financial transactions over a given time period.

A bookkeeper is a person in charge of bookkeeping.

Bookkeeping is a clerical job. Bookkeepers do not need any specialized knowledge or skills.

The bookkeeping process does not include financial statements. The bookkeeping procedure adheres to accounting rules and concepts.

How Much Does It Cost To Outsource Bookkeeping?

Many owners of small businesses outsource their bookkeeping to an accounting firm. Outsourced bookkeeping prices are comparable to those charged by a contract bookkeeper, with an ordinary monthly fee ranging from $250 to $2,000, based on the amount and volume of transactions.

Eicra charges $60 per hour for bookkeeping services. Our customizable Accounting Foundations Package begins at $250 per month as well as includes a variety of functions such as bookkeeping, bank/credit card consolidations, and payroll.

Users can also outsource invoice computation to Eicra so that we can manage all of your accounting transactions.

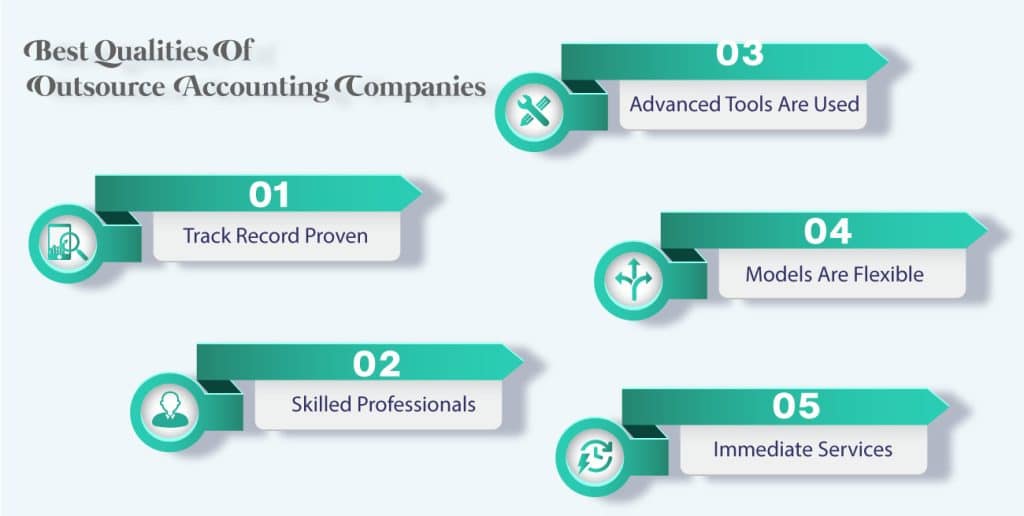

Best Qualities Of Outsource Accounting Companies?

According to recent statistics, 78% of businesses worldwide are positive about their outsourcing partners. One of the most important factors that businesses consider when selecting outsourcing partners is trustworthiness.

But how can you be certain that the outsourced accounting provider you choose is trustworthy? Choosing a stable partner to outsource your accounting services does not have to be difficult. We can assist you.

Here are a few features of a standout outsourced accounting service supplier that are reliable, competent, and trustworthy, so you can shortlist the right one.

-

Track Record Proven:

Nothing demonstrates trustworthiness more than a particularly long and proven track history in an outsourced service provider.

Look at the number of customers they’ve worked with and the amount of time they’ve been in business. The more experienced provider is the more secure, it should be to cooperate with them.

-

Equipped With Skilled Professionals:

A reliable outsourced accounting provider does have a committed team of experts on staff. They will be skilled and experienced professionals with a track record of managing complex accounting tasks.

This type of service provider also should allow you to access skilled people and meeting them before hiring them.

-

Advanced Tools Are Used:

Accounting tasks are modernized, and advanced software and tools efficiently generate required reports and information.

As a result, collaborating with an outsourcing company whose expert team uses cutting-edge tools and software to provide the best remedies is a fantastic idea. Find out if they employ industry-leading software.

-

Models Of Engagement Are Flexible

A flexible working method is one of the quality standards for completing projects on time. A good outsourcing partner should provide engagement models that meet the needs of each client’s business.

Your perfect accounting outsourcing company will offer a variety of engagement models with scalability as a key benefit.

-

Immediate Services:

On-time work delivery is a critical consideration when deciding whether to outsource to a service provider. A good accounting outsourcing partner guarantees both on-time delivery and solid results.

To make the best choice, it is critical to carefully determine the primary qualities of a service provider.

Potential Drawbacks of Outsourced Accounting Services

Here are some of the potential drawbacks of using outsourced accounting services:

-

Hidden Fees:

Any paid service can experience scope creep. One task can quickly turn into several, resulting in additional costs that business owners were unaware of (or forgot about) at the beginning.

Making month-to-month relationships explicit and setting clear expectations from the start can help to reduce the likelihood of this happening.

To avoid any hidden costs, it is also critical to work with dependable and reputable service providers.

-

Less Power

Business owners may find it difficult to hand over the management of their financial documents to a third party.

While they can often contact the account executive for updates and periodic reports, they must have faith in the outsourced connection.

Starting with a thorough onboarding that clearly defines obligations, policies, and processes, establishes expectations, and ensures timely communication is recommended. This gives business owners more authority over the actively engaging me.

-

Issues with Accessibility

There are some benefits to having someone on staff who really can respond to investigations quickly.

While a company’s outsource workforce is always available, reactions are not always instant. Physical distance can be a barrier.

A good outsourced accounting firm, on the other hand, will have solid communication processes in place to ensure that your team is always accessible as well as ready to help.

Setting up a communication timetable and delegating obligations with the companies outsource provider can also be beneficial.

5 Tips For Who Wants To Outsourcing Their Accounting

While accounting outsourcing is becoming more popular, many business owners remain skeptical of the practice. That’s a positive idea, because you can’t just employ the first firm you come across online or based on a recommendation!

You must also take the necessary steps from the start in order for your connection with a financial reporting outsource partner to succeed.

If you’re ready to make the big switch to accounting outsourcing, here are 5 pointers to get you started.

-

Determine Your Requirements

Accounting entails a variety of functions, and you may not need to outsource all of them. It’s a good idea to identify your necessities so you don’t overspend on accounting services.

Tasks that are outsourced can be classified as highly skilled, specialist, or repetitive. For example, you may require expert financial advice each month, ongoing IT assistance for your accounting system, or assistance with payables or shipping inventory.

-

Be Specific in Your Expectations

Check out your current accounting system to see what irritates you the most. Consider your objectives and what you hope to accomplish by outsourcing accounting services.

Maybe you want a good reporting system, or maybe you just want to keep track of your cash and profits easily.

Outsourcing projects frequently fail as a result of ambiguous requirements and an unclear scope of work.

Being clear about your preconceptions will keep you connected with your company’s standing and provide a direction for you outsource partner to work in.

-

Choose expertise over low prices

Once you’ve established your goals, it’ll be simple to choose an accounting outsourcing firm to handle your company’s accounting needs.

Accounting professionals have different levels of knowledge, encounter, and expertise, as well as different strengths and weaknesses.

Moreover, accounting firms may offer a wide range of services or specialize in a specific role.

-

Don’t Forget About the Security

It’s unlikely, as most business owners are nervous to outsource their accounting due to data security concerns. However, you only need to be as cautious as if you were looking to hire an in-house accountant!

Check references and ensure that the outsource services meet basic compliance requirements to prevent fraud from the start.

Before making a decision, talk to them about their security measures and clear up any doubts you have.

-

Effective Communication

Effective communication is essential in all business transactions, but with the goal of cost-cutting as well as improving bottom lines, it’s easy to lose sight of what’s important.

Whether you’re speaking with potential outsource collaborators about your company’s specific goals or discussing security concerns, make sure your message is clear. And, whenever in doubt, always clarify!

Maintain open lines of communication even after you’ve found the perfect firm for your needs. Convey texts through established channels so that both parties involved know who to contact if there is an urgent need for clarification.

Why To Outsource It With Us

There are numerous benefits for clients who choose to outsource their accounting activities. To start with, cost-efficiency, and closing with contract flexibility or scaling the number of duties.

Accounting and bookkeeping are important aspects of business, but they are also complicated. It takes time and specialized knowledge. Without accounting experience, many errors may occur, causing your business to suffer or even go bankrupt.

Eicra Soft Ltd, with over 500 customers from all over the world, is a dependable accounting service provider for small and medium-sized businesses. You can look over our services in accounting and bookkeeping or contact us for a quote.

Sorry, the comment form is closed at this time.