Payroll Processing Services

Streamlined Payroll Processing for Seamless Operations

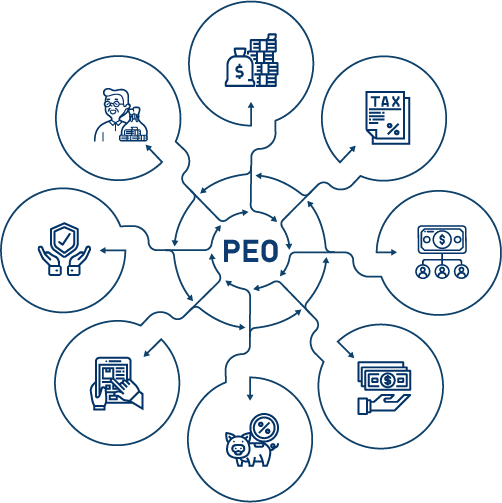

Eicra.com supports your business to grow with PEO Payroll Services. When a company hires our PEO (professional employer organization) for the services, it becomes a co-employer. We assume the responsibility of managing the client’s HR administration and employee taxes by using our tax identification numbers.

The PEO is generally responsible for payroll services related tasks, including paying salaries, depositing employment taxes and issuing staffs. PEO payroll service helps administer payments. It distributes to full- and part-time employees, and sometimes vendors and contractors. Our company also maintains responsibility for day-to-day tasks.

Our HR & Payroll Services

Eicra.com engages the payroll services of PEO in your business. We ensure that the PEO is functioning accurately in the process. We also ensure the compliance of your business. To reduce risks, clients should ensure they partner with a PEO who is required to maintain strict financial and tax reporting requirements. Moreover, we provide financial assurance and adhere to industry best practices like we do for our clients.

Our 6 Payroll Services For Simplifies Your Expansion

PEOs process of payroll services sometimes pay national employment taxes. Many also integrate payroll with time and attendance, which helps decrease duplicate data entry and mistakes. With the features of payroll software, the worker taxes are filed within the deadline.

Some PEOs offer end-to-end talent services, like recruiting and strategic recruitment, employee training and engagement, and performance management. Our PEO Payroll services providers work in this aspects.

PEOs typically have compliance specialists who can support you protect your business from fines and penalties. Our area of expertise may include payroll tax law and reporting requirements, unemployment insurance, workers compensation, hiring and HR compliance.

In addition to workers reimbursement insurance, our PEOs sometimes offer safety audits and training programs to assist you limit claims. We can also assist with Occupational Safety and Health Administration (OSHA) inspections.

We provide PEO HR professionals who provide HR services and support. If you already have an in-house HR person or team, we can be your PEO partners and we both can work with strategically and administratively.

A co-employment procedure often comes with access to high-quality, cost-effective health insurance, as well as retirement benefits and other employee bonuses. The PEO will usually handle the employee enrollment for these welfares and process claims for you.

Our 4 Goals To Help You In The Process

Eicra.com is a top notched PEO (professional employee organization) company in Bangladesh because of their flawless services structure

1. Employer Of Record

Our EOR collaborates with its customer to assume its employment responsibilities. An agreement is formed and a contract is signed. Although our EOR takes control of the employee. We retain control over day-to-day business activities. We provide a great service indeed.

2. Risk Reduction

We have introduced an automatic solution for payroll management that maintains the accuracy of payroll calculation and evades the double or cross-check of payroll. We have a committed team to handle the payroll process that upholds accuracy and reduce risks.

3. Accuracy

Whether you’ve just started a business or are part of a bigger corporation, we’re here to assist you streamline your payroll process. Our Outsourcing payroll service helps you to focus on essential business tasks while freeing up resources including important human capital.

4. Reduced Turnover

Our specialists are well qualified and experienced in payroll management. We take care of whole Employee Compensation, Benefits, Incentives, Tax Deductions, Statutory Compliance and other in a Standard Way. Payroll services that make the staffs feel secure and build confidence to reduce turnover.

FAQ

Is Payroll Outsourcing Easy?

The amounts to pay your staff can be called, faxed or emailed to us, or input into a secure internet site, depending on the level of sophistication and control you require. Once we figure out your net pay, we’ll prepare your tax returns, printing checks and delivering them to you, as well as arranging to have tax monies deducted from your account and paid.

How do you make a direct deposit?

We require both your business and your employees’ specific account numbers. The bank processes Direct Deposit transactions. In the banking law requires two business days between sending payroll information to us and pay day for monies to move through the Automated Clearing House system.

How do I get a payroll check if I need it during a pay period?

We can prepare the check for you or you can write the check yourself. Feel free to call us if you hand-write the check.

Do you keep track of vacations and sick days?

Just provide us with documentation regarding your plans, and we will calculate and track accrued and taken PTO each pay period.

How long would it take to set up payroll?

There are a number of factors that can affect this, such as the size and frequency of your payroll and your current set-up. Our general rule of thumb is two to three weeks, which allows us to run a parallel run if needed and thoroughly check all the information provided.