Tax Planning 2023: Get Your Business Ready for Tax Season

As a business owner, it is crucial to begin preparing for Tax Planning season early in order to avoid any last-minute surprises or penalties. Keeping accurate records of all income and expenses throughout the year is the first step to ensuring a smooth tax preparation process.

Understanding tax deductions that are available to businesses can also help to reduce taxable income and lower tax liability.

Consider hiring a professional accountant or tax preparer to assist in preparing your tax return. They can help identify potential tax deductions and ensure that your tax return is accurate and complete.

Staying up-to-date on tax laws that may affect your business is also important. Any changes in tax laws could impact your tax liability and business operations.

Business owners can prepare for tax season with confidence and ease. Proper tax preparation can save time and money and allow business owners to focus on growing their business rather than worrying about tax compliance.

Approximately How Much Do Small Businesses Pay in Taxes?

The amount that small businesses pay in taxes can vary widely depending on a number of factors such as the type of business entity, the amount of income earned, the deductions claimed, and the location of the business.

For example, sole proprietors and partnerships are considered pass-through entities, meaning that the profits or losses of the business are passed through to the owner’s personal tax return.

This means that the owner will pay taxes on the business income at their personal tax rate, which can range from 10% to 37% depending on their income level.

On the other hand, corporations are taxed as separate entities and are subject to a corporate tax rate of 21% on their profits.

However, if the corporation distributes profits to shareholders in the form of dividends, those dividends may be subject to additional taxes at the individual level.

Additionally, small businesses may be eligible for various deductions and credits, such as the Section 199A Qualified Business Income Deduction, which can help to reduce their tax liability.

Overall, the amount that small businesses pay in taxes can vary widely and depends on a number of factors. It is important for business owners to work with a qualified tax professional to understand their tax obligations and take advantage of any available deductions and credits.

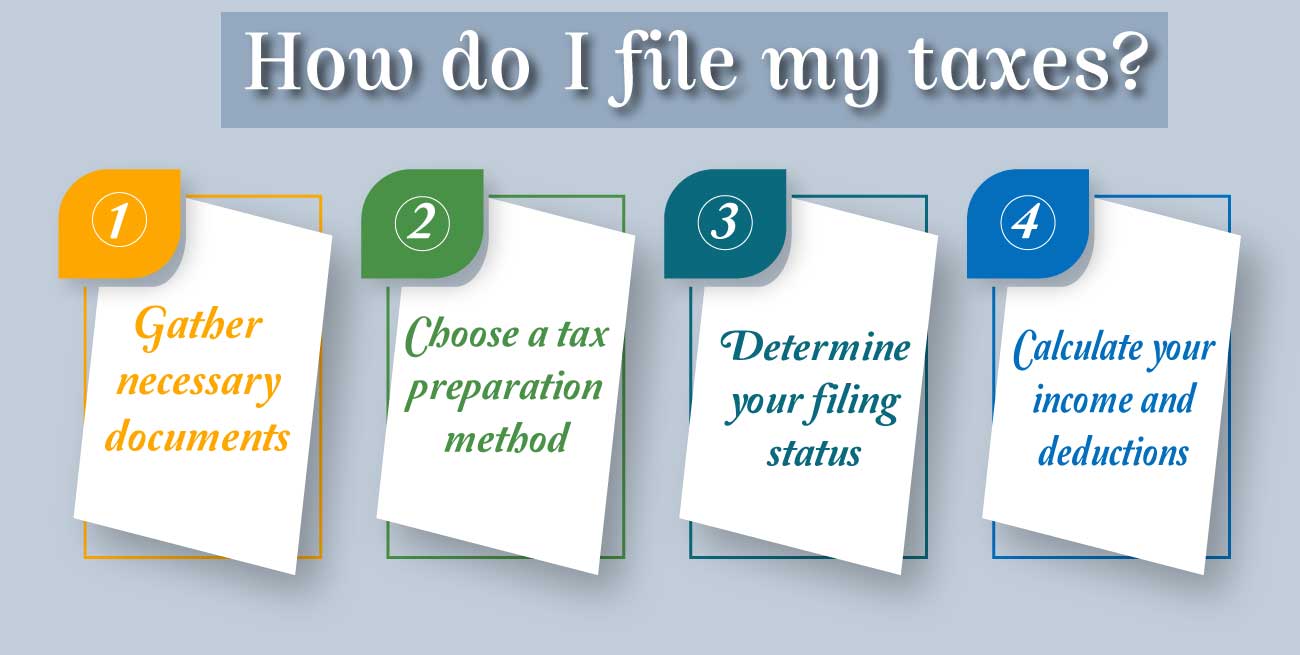

I. How do I file my taxes?

Filing income tax can seem overwhelming, but with a little preparation and guidance, the process can be made simpler. Here are the general steps for filing income tax:

1. Gather necessary documents: Gather all documents necessary for filing your tax return, such as W-2s, 1099s, receipts, and any other relevant financial information.

2. Choose a tax preparation method: Decide whether to file your taxes yourself using tax preparation software or to hire a tax professional to prepare and file your taxes for you.

3. Determine your filing status: Determine your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

4. Calculate your income and deductions: Calculate your income and deductions to determine your taxable income.

5. File your tax return: File your tax return by the deadline, which is typically April 15th of each year. You can file your tax return electronically or by mail.

6. Pay any taxes owed: If you owe taxes, you must pay them by the tax filing deadline to avoid penalties and interest.

7. Keep copies of your tax return and documents: Keep a copy of your tax return and all supporting documents for at least three years.

It is important to note that tax laws can be complex and may vary by jurisdiction. It is recommended to seek the advice of a qualified tax professional or use a reputable tax preparation software to ensure accurate filing and compliance with all tax laws.

II. How can I file my own taxes?

If you are self-employed and have earned income of at least $400 during the tax year, you are required to file self-employment tax. Here are the general steps to follow when filing self-employment tax:

1. Determine your net self-employment income: Calculate your net self-employment income by subtracting your business expenses from your self-employment income.

2. Calculate your self-employment tax: Multiply your net self-employment income by the self-employment tax rate, which is currently 15.3%. This tax rate consists of 12.4% for Social Security and 2.9% for Medicare.

3. Complete Schedule SE: Use Schedule SE to calculate your self-employment tax liability and report it on your Form 1040 tax return.

4. Report self-employment income: Report your self-employment income on Schedule C or Schedule C-EZ, which are forms used to report income and expenses for sole proprietors and single-member LLCs.

5. Deduct business expenses: Deduct any eligible business expenses from your self-employment income to reduce your taxable income.

6. File your tax return: File your tax return by the deadline, which is typically April 15th of each year.

7. Pay any taxes owed: If you owe taxes, you must pay them by the tax filing deadline to avoid penalties and interest.

It is important to note that tax laws can be complex and may vary by jurisdiction. It is recommended to seek the advice of a qualified tax professional or use a reputable tax preparation software to ensure accurate filing and compliance with all tax laws.

III. How do I file my employment taxes?

As an employer, you are required to file employment taxes, which include federal income tax withholding, Social Security and Medicare taxes, and federal unemployment tax. Here are the general steps to follow when filing employment tax:

1. Obtain an Employer Identification Number (EIN): Apply for an EIN from the Internal Revenue Service (IRS) if you don’t already have one. This number will be used to identify your business when filing employment taxes.

2. Determine your tax liability: Calculate your employment tax liability by withholding the appropriate amount of federal income tax, Social Security tax, and Medicare tax from your employees’ wages.

3. File Form 941: File Form 941, which is the Employer’s Quarterly Federal Tax Return. This form is used to report your employment tax liability for each quarter of the year.

4. Deposit taxes: Deposit the employment taxes you have withheld from your employees’ wages and your portion of Social Security and Medicare taxes. You can do this electronically through the Electronic Federal Tax Payment System (EFTPS) or by mail using a Form 8109-B.

5. File Form 940: File Form 940, which is the Employer’s Annual Federal Unemployment (FUTA) Tax Return. This form is used to report your federal unemployment tax liability for the year.

6. Keep records: Keep accurate records of all employment taxes you have withheld and paid throughout the year.

It is important to note that tax laws can be complex and may vary by jurisdiction. It is recommended to seek the advice of a qualified tax professional or use a reputable tax preparation software to ensure accurate filing and compliance with all tax laws.

IV. How should excise tax be filed?

Excise tax is a tax imposed on certain types of goods or services, such as gasoline, tobacco, and alcohol. If you are required to file excise tax, here are the general steps to follow:

1. Obtain an Excise Tax Registration Number (ETIN): Apply for an ETIN from the Internal Revenue Service (IRS) if you don’t already have one. This number will be used to identify your business when filing excise tax.

2. Determine your tax liability: Calculate your excise tax liability based on the type and quantity of goods or services subject to the tax.

3. File Form 720: File Form 720, which is the Quarterly Federal Excise Tax Return. This form is used to report your excise tax liability for each quarter of the year.

4. Deposit taxes: Deposit the excise taxes you owe through the Electronic Federal Tax Payment System (EFTPS) or by mail using a Form 8109-B.

5. Keep records: Keep accurate records of all excise taxes you have paid throughout the year.

It is important to note that tax laws can be complex and may vary by jurisdiction. It is recommended to seek the advice of a qualified tax professional or use a reputable tax preparation software to ensure accurate filing and compliance with all tax laws.

5 Easy Steps to Preparing Your Tax Planning

Here are five steps to preparing your taxes:

1. Gather all necessary documents: Gather all the necessary documents such as W-2s, 1099s, receipts for deductible expenses, and any other tax-related documents that you may have received throughout the year.

2. Determine your filing status: Determine your filing status based on your marital status and dependents. Your filing status will determine your tax bracket and standard deduction.

3. Calculate your taxable income: Calculate your taxable income by adding up all your income for the year and subtracting any deductions or credits that you are eligible for.

4. Choose how to file: Choose how you want to file your taxes. You can file electronically using tax software or hire a tax professional to prepare your taxes for you.

5. File your taxes: File your taxes by the deadline, which is typically April 15th of each year. You can file electronically or mail a paper return.

It is important to keep in mind that tax laws can be complex and may vary by jurisdiction. It is recommended to seek the advice of a qualified tax professional or use a reputable tax preparation software to ensure accurate filing and compliance with all tax laws.

When Are Taxes Due For 2022?

The deadline for filing 2022 taxes for individuals is April 18, 2023. This is because the usual deadline of April 15th falls on a weekend, and the following Monday is a holiday in Washington D.C., where the IRS is located.

Therefore, the filing deadline is pushed to the next business day, which is April 18, 2023. It’s important to note that this deadline applies to both filing your tax return and paying any taxes owed for the 2022 tax year.

If you need more time to file your taxes, you can request a six-month extension by filing Form 4868, but this only extends the deadline for filing your tax return and not for paying any taxes owed.

How Important Are TIN Certificates?

TIN (Taxpayer Identification Number) certificates are very important for businesses and individuals for the following reasons:

- Tax Compliance:

TIN certificates are issued to individuals and businesses that are registered as taxpayers with the tax authorities. They are used to track tax transactions and ensure compliance with tax laws and regulations.

Without a TIN certificate, a taxpayer cannot file tax returns or make tax payments, which can result in penalties and fines.

- Financial Transactions:

TIN certificates are required for opening bank accounts, applying for loans, and engaging in other financial transactions. Financial institutions use TINs to verify the identity of the taxpayer and ensure that they are registered with the tax authorities.

- Government Contracts:

TIN certificates are often required for businesses to bid on government contracts. Government agencies use TINs to verify that the business is registered with the tax authorities and is in compliance with tax laws.

- International Transactions:

TIN certificates are required for businesses and individuals engaging in international transactions. TINs are used to identify taxpayers for tax purposes in other countries and to ensure compliance with tax laws and regulations.

- Business Reputation:

Having a TIN certificate can enhance the reputation of a business. It shows that the business is registered with the tax authorities and is in compliance with tax laws, which can improve trust and confidence in the business among customers and suppliers.

TIN certificates are essential for tax compliance, financial transactions, government contracts, international transactions, and business reputation. They play a critical role in ensuring that businesses and individuals are in compliance with tax laws and regulations.

How to Apply For a TIN Certificate: Step-by-Step Instructions

The process for applying for a TIN (Taxpayer Identification Number) certificate may vary depending on the country or jurisdiction. However, here are some general step-by-step instructions that may be helpful:

Step 1: Determine the Eligibility

Determine if you are eligible for a TIN certificate based on the tax laws and regulations of your country or jurisdiction. In many cases, individuals and businesses that earn income or engage in taxable activities are required to register with the tax authorities and obtain a TIN certificate.

Step 2: Gather Required Documents

Gather the required documents to apply for a TIN certificate. These may include identification documents such as a passport, national ID card, or driver’s license, proof of address such as a utility bill, and other relevant documents as specified by the tax authorities.

Step 3: Complete the Application Form

Complete the TIN certificate application form. This can usually be done online or in-person at the tax office. Provide accurate and complete information in the application form, including your personal information, business information, and other relevant details.

Step 4: Submit the Application

Submit the TIN certificate application along with the required documents to the tax authorities. Depending on the jurisdiction, you may be required to pay a registration fee.

Step 5: Wait for Processing

Wait for the processing of your TIN certificate application. The processing time may vary depending on the jurisdiction and the volume of applications being processed. In some cases, you may be able to check the status of your application online or by contacting the tax authorities.

Step 6: Receive TIN Certificate

Once your TIN certificate application is processed and approved, you will receive your TIN certificate. Keep the certificate in a safe place and use it when engaging in financial transactions or other activities that require proof of tax registration.

To apply for a TIN certificate, you need to determine eligibility, gather required documents, complete the application form, submit the application, wait for processing, and receive your TIN certificate.

The Procedure Of Registering A TIN Number

The procedure for registering for a TIN (Taxpayer Identification Number) may vary depending on the country or jurisdiction. However, here are the general steps involved in registering for a TIN number:

- Check Eligibility:

Make sure that you are eligible to apply for a TIN number. In most cases, TIN numbers are issued to individuals or businesses that are required to pay taxes.

- Gather Required Information:

Gather all the necessary information and documents needed to apply for a TIN number. This may include your name, address, date of birth, social security number, or other identification documents.

- Fill out Application Form:

Obtain an application form for a TIN number from the relevant tax authority or government agency. Fill out the form completely and accurately, providing all the necessary information.

- Submit Application:

Submit the completed application form along with any required documents to the relevant tax authority or government agency. You may need to submit your application in person, by mail, or online, depending on the requirements.

- Wait for Processing:

Wait for the tax authority or government agency to process your application. The processing time may vary depending on the country or jurisdiction, but it typically takes a few days to a few weeks.

- Receive TIN Number:

Once your application has been approved, you will receive a TIN number. Make sure to keep your TIN number in a safe place and use it whenever you file your tax returns or interact with the tax authority.

It is important to note that the exact procedure for registering for a TIN number may vary depending on the country or jurisdiction. It is recommended to consult with the relevant tax authority or government agency for specific guidelines and requirements.

Where Can I Check My Tax Identification Number Online?

The process for checking your Tax Identification Number (TIN) online may vary depending on the country or jurisdiction. However, here are some general steps you can follow:

- Visit the website of the tax authority in your country or jurisdiction. In many cases, there may be a specific section for TIN verification or lookup.

- Look for a TIN verification tool or search function on the website. This may be listed under “Taxpayer Services” or “Online Services” on the website.

- Enter your TIN number in the provided field or search bar. You may also need to enter additional information such as your name, date of birth, or other identifying information.

- Submit your search or verification request. The system will then process your request and display the information associated with your TIN, such as your name, address, and tax status.

- If you are unable to find a TIN verification tool on the tax authority website, you may need to contact the tax authority directly by phone or in person to request TIN verification.

To check your TIN online, visit the website of the tax authority in your country or jurisdiction, look for a TIN verification tool or search function, enter your TIN number and other identifying information, submit your search request, and view the information associated with your TIN.

Why Should Your Small Business or Company Get an E-tin Certificate?

There are several reasons why your small business or company should consider getting an E-TIN (Electronic Taxpayer Identification Number) certificate:

- Legal Requirement:

In many countries, having an E-TIN certificate is a legal requirement for businesses and companies to operate. Failure to obtain an E-TIN may result in penalties, fines, or legal consequences.

- Tax Compliance:

An E-TIN certificate helps businesses and companies to stay compliant with tax laws and regulations. By having a valid E-TIN, you can easily file your tax returns and make timely tax payments, avoiding any issues with the tax authorities.

- Business Credibility:

An E-TIN certificate provides your business or company with credibility and legitimacy in the eyes of your customers, suppliers, and partners. It demonstrates that your business is registered with the tax authorities and is operating legally.

- Access to Government Benefits:

In some countries, businesses with a valid E-TIN certificate are eligible for certain government benefits, such as tax incentives, loans, or grants. These benefits can help your business grow and expand.

- Easy to Manage:

An E-TIN certificate is a digital document that can be easily managed and accessed online. You can update your information, check your tax status, and file your tax returns conveniently from your computer or mobile device.

Getting an E-TIN certificate for your small business or company is essential to comply with tax laws, gain credibility, access government benefits, and manage your tax affairs efficiently.

E-TIN vs. TIN: Understanding the Differences and Advantages

Here is a table summarizing the key differences and advantages of E-TIN and TIN:

Features | TIN | E-TIN |

Format | Physical document or card | Digital certificate |

Convenience | Requires physical presence for issuance and management | Issued and managed online |

Accessibility | May require in-person visits to tax offices for updates and inquiries | Can be easily accessed and managed online |

Security | Physical documents can be lost or stolen | Digital certificates may be more secure due to encryption and password protection |

Cost | May incur printing and distribution costs | Issued free of cost by some tax authorities |

Usage | Generally used for tax compliance and identification purposes | Same as TIN, but with additional benefits such as digital filing and easier access to tax information |

Government Benefits | May be eligible for tax incentives or benefits | Same as TIN, but with additional benefits such as easier access to government services and online filing capabilities |

Important dates for the 2022 tax year's 2023 filing season

Here are some important deadlines for the 2022 tax season in 2023:

1. April 18, 2023: This is the deadline for filing 2022 taxes for individuals. It’s important to note that this date is different from the usual deadline of April 15th due to a weekend and a holiday.

2. October 16, 2023: This is the deadline for individuals who have requested an extension to file their tax returns. It’s important to note that this extension only applies to filing the tax return, not to paying any taxes owed.

3. March 15, 2023: This is the deadline for filing 2022 taxes for S-Corporations and partnerships that use the calendar year as their tax year.

It’s important to note that these types of businesses pass their income and deductions through to their owners, who report this information on their individual tax returns.

4. April 18, 2023: This is the deadline for making 2022 contributions to a Traditional IRA, Roth IRA, or Health Savings Account (HSA).

It’s important to note that contributions to a Traditional IRA or HSA may be tax-deductible, while contributions to a Roth IRA are not tax-deductible.

5. January 31, 2023: This is the deadline for employers to provide their employees with W-2 forms, which report their wages and taxes withheld for the previous year.

It’s also the deadline for businesses to issue 1099 forms to independent contractors and other non-employees who received $600 or more in payments during the year.

It’s important to keep in mind that tax laws can be complex and may vary by jurisdiction. It is recommended to seek the advice of a qualified tax professional or use a reputable tax preparation software to ensure compliance with all tax laws and deadlines.

General Tax Calendar OR Tax Planning

Here is a table for the general tax calendar in the United States:

Date | Deadline |

January 31 | W-2 and 1099 forms due to recipients |

March 15 | Deadline for S-Corporations and partnerships to file tax returns |

April 15 | Individual income tax returns due |

April 15 | Deadline to make contributions to IRA or HSA for previous year |

April 15 | First quarter estimated tax payments due |

June 15 | Second quarter estimated tax payments due |

September 15 | Third quarter estimated tax payments due |

October 15 | Extended deadline for individual income tax returns |

October 15 | Extended deadline for filing certain business tax returns |

December 31 | Deadline for making certain tax-related payments or contributions |

It’s important to note that there may be additional deadlines or specific requirements for certain taxpayers or businesses. It’s recommended to consult with a tax professional or the IRS for specific information related to your tax situation.

How To Get Help from a Tax Professional

Getting help from a tax professional can be useful if you have a complex tax situation or if you’re unsure about how to prepare your tax return. Here are some ways to get help from a tax professional:

- Hire a certified public accountant (CPA):

A CPA is a licensed accounting professional who can provide a variety of tax services, including tax preparation, tax planning, and tax advice.

CPAs are required to pass an exam and meet certain education and experience requirements, so they are knowledgeable about tax laws and regulations.

- Work with an enrolled agent (EA):

An EA is a tax professional who has been authorized by the IRS to represent taxpayers in tax matters.

EAs have passed an exam and must complete ongoing education requirements to maintain their credentials. They can provide tax preparation, planning, and representation services.

- Use a tax preparation service:

There are many tax preparation services available, both online and in-person. These services can help you prepare and file your tax return, and some may offer tax planning and advice services as well.

- Seek help from a tax attorney:

A tax attorney is a legal professional who specializes in tax law. They can provide advice and representation for complex tax issues, including tax disputes with the IRS.

When choosing a tax professional, it’s important to do your research and choose someone who is qualified, reputable, and experienced. You should also consider the cost of the services and make sure they fit within your budget.

7 Pro Tips to Make Filing Your 2023 Taxes Easier

Here are 7 pro tips to make filing your 2023 taxes easier:

- Keep organized records:

Keep all your important tax-related documents, such as receipts, invoices, and bank statements, in a safe and organized place throughout the year. This will make it easier to find what you need when it comes time to file your taxes.

- Plan ahead for deductions:

If you plan to itemize your deductions, keep track of your expenses throughout the year so you can take advantage of as many deductions as possible.

- Keep track of charitable donations:

Keep a record of any donations you make to charitable organizations, including the date, amount, and the organization’s name and contact information.

- Maximize retirement contributions:

Consider maximizing your contributions to retirement accounts, such as a 401(k) or IRA. This can help lower your taxable income and reduce your tax bill.

- Take advantage of tax credits:

Be aware of tax credits that you may be eligible for, such as the child tax credit, earned income tax credit, and education tax credits.

- Use tax preparation software:

Consider using tax preparation software to make the process of filing your taxes easier and more efficient. These programs can help you identify deductions and credits you may be eligible for and can even file your taxes electronically.

- File on time:

Make sure to file your tax return on time to avoid penalties and interest charges. If you need more time to file, you can request an extension, but keep in mind that you will still need to pay any taxes owed by the original due date.

Final Words

Tax planning is a crucial aspect of financial management that helps individuals and businesses reduce their tax liabilities while ensuring compliance with tax laws and regulations.

Effective tax planning involves understanding the tax code, analyzing financial and business activities, and implementing strategies to minimize taxes owed.

Some common tax planning strategies include maximizing deductions and credits, investing in tax-advantaged accounts, and structuring business transactions to reduce tax liabilities.

It is important to note that tax planning should not involve illegal or unethical practices, such as tax evasion or fraud.

By engaging in tax planning, individuals and businesses can maximize their financial resources, increase profitability, and avoid potential penalties or legal issues related to noncompliance with tax laws.

Seeking the guidance of tax professionals or financial advisors can also be beneficial in developing effective tax planning strategies that align with specific financial goals and objectives.

FAQs

1. Why is tax planning important?

Ans: Effective tax planning can help individuals and businesses reduce their tax liabilities, increase profitability, and avoid potential penalties or legal issues related to noncompliance with tax laws.

2. What are some common tax planning strategies?

Ans: Common tax planning strategies include maximizing deductions and credits, investing in tax-advantaged accounts, and structuring business transactions to reduce tax liabilities.

3. Is tax planning legal?

Ans: Yes, tax planning is legal and is an important aspect of financial management. However, it is important to note that tax planning should not involve illegal or unethical practices, such as tax evasion or fraud.

4. When should I start tax planning?

Ans: Tax planning should be an ongoing process that is integrated into financial and business planning. It is recommended to start tax planning early in the year to ensure that all tax-related activities and transactions are properly documented and planned for.

Sorry, the comment form is closed at this time.